Tax Preparation

Streamline Your Tax Needs

Individual State & Federal Tax Preparation

Specific tax-related requirements and considerations vary from person to person; therefore, it is essential to assess each individual’s financial situation, goals, and obligations.

Tailoring tax strategies to these unique circumstances can optimize deductions, minimize liabilities, and enhance overall financial health.

Engaging with a tax professional can provide valuable insights and ensure compliance with current tax laws, ultimately leading to more effective tax planning and peace of mind.

Tax Preparation Checklist

- Driver's License, SSN's and ID's for you, your spouse and dependents

- W2's, Tips and household employee wages not reported on W2 forms

- 1099R forms, SSA 1099 and RRB-1099 forms

- 1099 NEC & 1099K forms, sales records, profit & loss statements, expense receipts & records and cost of goods sold

- 1099 MISC - showing rent payments received, rents received not reported on 1099 MISC, receipts and other records for expense and depreciation schedule

- 1099-S forms, escrow closing statement

- 1099-G for government payments, 1099-PATR forms

- 1095-A forms

- Documents of taxes you've paid

- Receipts and records for qualified energy-saving upgrades

- Chartible gift contributions

- Medical and dental expenses paid, mileage for medical travel and lodging expenses for medical travel

- 1098 forms, home mortgage interest or points not reported on 1098 forms

- SALT douments

- 1098 E forms and statements if 1098 forms not received

- Receipts for qualified adoption expenses and employer reimbursements of adoptions expenses (if any)

- Amount paid for child and dependent care, care provider's names, address and taxpayer identification number

- 1098-T forms and records for qualified educational expenses not included on 1098-T forms

- Bank account info for direct deposit and last year's tax return for general reference for e-filing and foreign bank account information

Get an Appointment

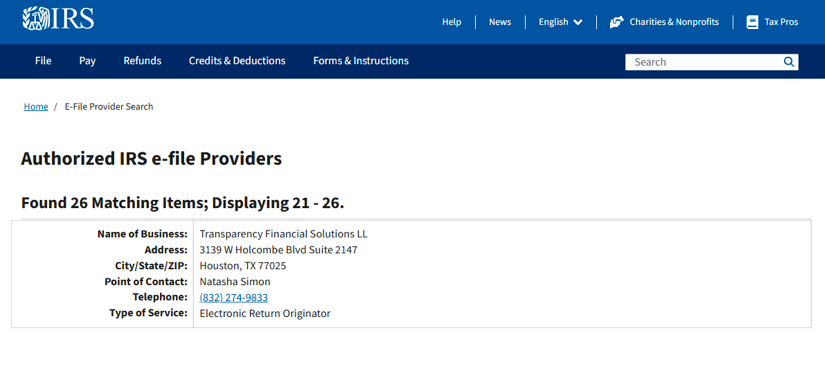

You are in good hands. As an IRS registered e-file provider, we handle tax filings with efficiency and security. We prioritize the protection of your information with top-notch security standards, and we are here to support you every step of the way. Rely on us to make your tax experience seamless and stress-free!